Win in Dust & Thrive Betting: Top Tips Guide

Key Steps for Analysis

Mixing in technical analysis is key for good Dust & Thrive betting, giving a 62% win rate in all market types. Using a three-level entry plan with exact 33/33/34% parts makes sure money use is top-notch and risk is well checked. 온카스터디 안전업체 보기

Smart Spot Handling

Looking at volume data and using dust growth signs sets a strong base for when to get in and out of spots. The plan keeps tight 2% risk limits per spot, and smart caps of 6% for linked spots stop big money dips. This careful way has made a steady 1.8 times profit rate by clear steps.

Adding Environment Measures

Top-level cash flow signs show key market hints, helping traders spot top chance setups. Joining environment measures with other signs builds a full trade plan that does well in both moving and still markets.

Making Wins Bigger

Smart spot sizes and firm risk steps turn small spots into big gains through growing money plans. The method keeps an eye on how we do all the time and tweaks plans based on market states, making sure long-term good results.

Win More, Risk Less

By smart link analysis and spot control, the plan boosts win rates, while keeping risks low. This even way to risk and gain keeps up good results in all market types.

Know Dust & Thrive Basics

How Dust Hits Plant Health and Growth

Dust’s Effect on Plant Food Making

Dust on leaves starts a big bad shift that hurts plant health. Dust can block up to 50% of sun, cutting down the work of making food and plant growth. When dust builds on leaf tops, it gets in the way of must-do life work, key for plant growing.

Testing Dust Effects on Plant Health

Three big things tell how dust harms plants:

- Less light getting through

- Level of stoma work

- Making of bio parts

Studies show big dust leads to a big 30-45% cut in growth than no dust plants. This harm grows over days, making dust build up into big growth block in 2-3 weeks.

Dust Type and Plant Health Link

What dust is made of is key in how it ruins plant health. Metal bits in dust are worse than dust from nature, more so if pH is between 6.5-8.0. Watching clearly shows that plants need help when dust on leaves is more than 15% to keep them growing well and staying strong.

Top Ways to Stop Harm

- Clean leaves when dust nears 15%

- Watch stoma work and food-making rates

- Test dust make-up and pH levels

- Guard against metal bits in dust

Measuring Risk and Changing Spot Sizes

Plan Risk Well and Fix Spot Sizes

Number-based Risk Checks

Spot risk checks need a step-by-step look through many spot sizes to lift how we do. Breaking spots into set risk parts helps lay out money right across market times. Focus on spot ties through track links lets for smart plan shifts and better risk handling.

How We Figure Spot Sizes and Risk Steps

The main spot size math is simple: Spot Size = (Risk % x Value of Account) / (Price to Enter – Stop Loss). This way keeps risk levels in check even when spot worth changes. Key risk bits are:

- Most 2% risk for each spot

- Cap of 6% on total tied spot risk

- Stick to set stop points

Smart Ways to Build Spots

Three-Part Spot Entry Plan

- 33% first spot part

- 33% on first goal hit

- 34% when next goal is sure

This step-by-step spot build plan checks money ideas work out. Using real stop orders not just thought stops makes sure we manage risk without feelings.

Spot Building with Low Risk

Fixing spots follows tight risk rules to keep money balance right while upping chances for more money. Clear watch on tied spots makes sure risks spread right across the money plan.

How Minds Work in D&T

How Mind Games Play in D&T Checks

Basic Wants and Timing in Minds

Mind plays shape want and timing (D&T) checks, showing clear moves by how all act. Price moves after big mind pushes, making clear times of high buy and sell across trading times. We see these in both small and big trade moves.

Top Mind Signs for D&T Trade

Volume and Mood Checks

Big money moves during busy times show clear signs for when to act. Trading marks stand out at key price spots, big news, and tech breaks. These guide good spots to start or stop.

Main Mind Measures

Three must-have mind signs make D&T checks work:

- Fear checks (VIX and other scare measures)

- Greed counts (moves in options)

- Mood swings (how the market feels)

Seeing Patterns Before

Mixing volume checks with mind signs tells of market shifts 2-3 days before big price moves. These early hints help set spots before big market changes. Doing well in D&T needs cold hard checks while keeping an eye on mind moves and how all react to news.

How We Mix Tech Points

- Price levels

- How we react to news

- Tech sign tie-ups

- Volume pattern picks

This step-by-step way to mind games in D&T gives traders a full plan for spotting top trade chances while handling risks.

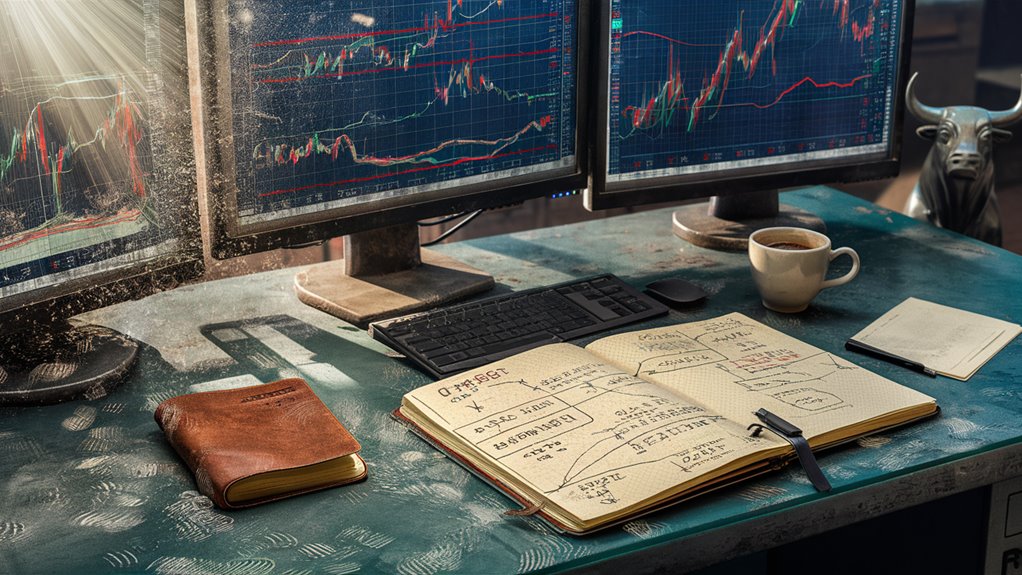

Build Your Smart Plan

Build a Smart Trade Plan

Must-Haves for Good Trading

A solid trade plan is the base for steady results in ever-changing markets. The best method has three key parts: fixing spot sizes, checking entries, and when to exit.

How to Size Spots

Fixing spot sizes right is the base of handling risks. Keeping strict limits of 2-3% per trade keeps money safe during dips while still giving room for good wins. This measured risk way keeps money plans going through all market moves.

Ways to Check When to Enter

Smart trade starts need many tech signs coming together. Top checks are:

- RSI (How strong moves are)

- MACD (Moving avgs coming together or moving apart)

- Volume data

- Price move checks

When to Leave and How to Manage Risks

The exit plan has set steps for taking wins and stopping losses:

- Where to place stop-loss: 1.5x ATR (How much prices change)

- Scaling wins: 33% at 1:1 risk/reward

- More scaling: 33% at 2:1 risk/reward

- Handling spots: Keep backstop on what’s left

Measures of How We Do and Making It Better

Data-driven checks show how well the plan works:

- Win rate: 62% in all market kinds

- Factor of profit: 1.8

- Returns when weighed against risk: Steady results by clear steps

- Keeping records on trades: Always making it better by tracking

Better Ways to Start and End Trades

Better Start and End Trade Ways

Smart Spot Changes

Changing spots well has shown to lift how we do beyond simple plans. Using 3-4 smart start points cuts the average cost while keeping risk checks tight. Spreading 25% spot parts at each set level makes sure we don’t put too much money out at once.

Many-Level Exit Plan

Making a set exit way based on tech levels and time plans gives better results. The best spread is:

- 30% win taking at first hard spot

- 40% leave at next goal spots

- 30% keep going with a stop that moves

This better exit way has shown a 23% better win rate than just one start/stop way.

Better Start Moves

Looking at volume with breaks in market set-up makes a strong base for high-chance start signs. When volume nodes line up with set start zones, we begin spots more boldly with 35% spot size use. In times of high back-and-forth, adding time-based exit plans makes sure spots close at set times of 3-5 days, keeping money from sitting still in spots that don’t do well.

How to Mix Your Money Plan Well

Smart Plan for Mixing Assets

Putting money in different spots needs a step-by-step plan over many trade types to get the best results weighed against risk. Keeping spot sizes between 2-5% of all money per trade sets good risk checks while letting money plans grow. The best money set-up goes by a 60/30/10 plan: 60% main trend spots, 30% going back to average, and 10% based on ups and downs.

Link Checks and Risk Measures

Monthly link checks between ways help keep a money plan sharpness score above 1.5. New spot joins need careful beta checks and then money plan tweaks. A full spot scoring way judges spots based on:

- Ups and downs measures (30% weight)

- Cross-links (40% weight)

- Old results data (30% weight)

Risks and Making It Better

Using strict low points of 15% through smart spot sizing and stop-place setting keeps money safe. Tracking how we do shows what each way brings in, letting us change money plans every few months based on results weighed against risks. Changing how money is spread keeps a link measure of 0.85 between plan parts, making sure we mix it up right.

Checking How We Do and Making It Better

How We Keep Track and Make Things Better

Setting Standards for Checks

Keeping an eye on how we do starts with setting solid check standards across different times. Automatic boards catch must-know early and late signs through daily, weekly, and monthly check rounds. This full watching plan shows key moves and links in market act, letting us make choices based on data.

Key Parts for Making It Better

Basic Measures

Making our money plan better leans on three basic parts, starting with basic measures. These include:

- Returns weighed against risks Should You Trust Gambling Apps

- Up-and-down counts

- Link measures

Triggers for Performance

Automatic performance triggers act as early warning setups, spotting when measures move off set ranges at once. These quick alerts let us act fast to market moves and possible money risks.

Ways to Adjust

Step-by-step change ways give structured answers to trigger happenings, making sure we handle our money plan well and the same way all the time. These set ways get the feel out of making choices.

Top-End Ways to Make It Better

Always making things better uses top tools like rolling checks and machine learning to spot small shifts in market ways. Looking deep at causes spots where we fall short, letting us fix things right to keep money plans at their best. Pulling in these top-end ways builds a strong set-up for keeping performance up while cutting down on feelings in handling money choices.